Demolition Report 2021

Introduction and Overview

2021 saw significant trends and changes in the Shipping industry with record breaking Container demand, surging steel prices, and the threat of returning lockdowns as new Covid-19 variants emerged. These factors have combined to result in a diverse demolition market.

Last year saw 704 vessels sold for scrap overall, with a combined DWT of 26.4 mil and a total scrap value of USD 2.7 bil. Scrapyards have stayed busy with the total number of vessels sent for demolition climbing by 20% since 2020, and 26% since 2019, when 583 and 558 vessels were scrapped respectively.

Cargo

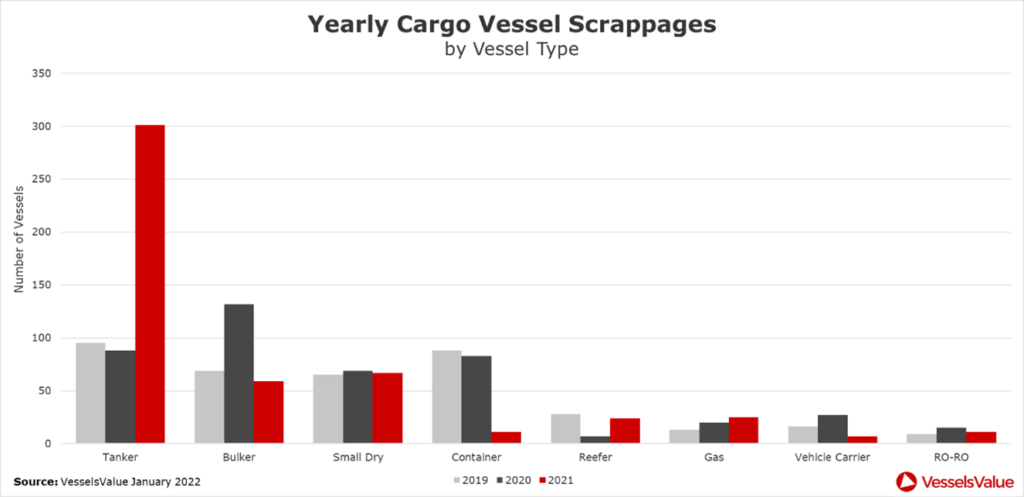

Tankers dominated the demolition market in 2021 with 301 vessels sold for scrap, accounting for 59% of all cargo vessels demolished.

The comparatively low number of Bulkers scrapped last year, at 59 vessels, comprised 11% of the scrapped fleet, whereas the 11 Container vessels sold for demolition made up only 2%.

The surge in Tanker scrapping represents a remarkable 242% increase from 2020, when a mere 88 Tanker demolition deals were closed. Static spot and TC rates have led to shipowners sending a large amount of older tonnage to the scrapyard, with many perhaps running out of patience awaiting a Tanker recovery.

Bulker demolition sales were down from 132 vessels in 2021, a decrease of 55% due to the 10 year highs seen previously in the charter market throughout 2021, which saw owners capitalising on the unprecedented rates. However, the most impressive decline to scrapping numbers came from the Container market, which saw an 87% reduction in scrapped vessels, from 83 vessels in 2020 to 11 in 2021. With rates during 2021 at historic highs, the low scrapping numbers for this vessel type are hardly surprising.

Buyers

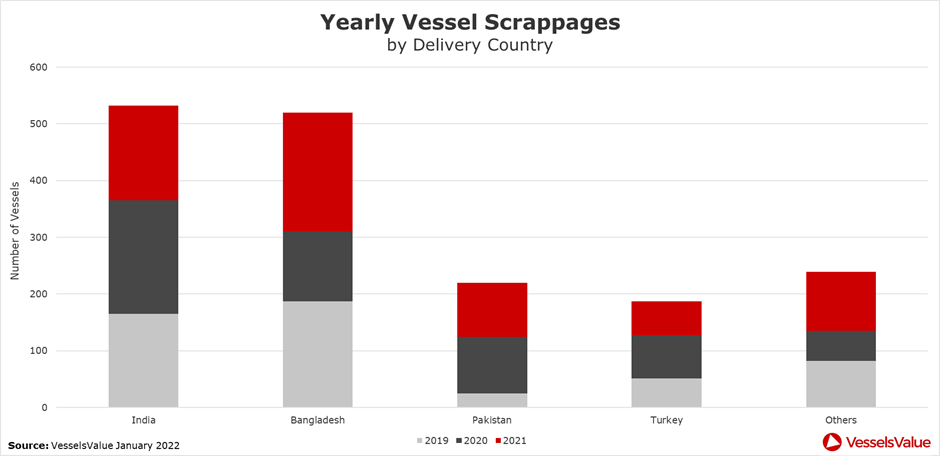

In 2021, it was Bangladeshi breaking yards working the hardest, demolishing 232 ships which accounted for 33% of vessels sold for recycling. Trailing not far behind was India, where 178 vessels were sent for demolition (25% of scrapped vessels), followed by Pakistan which received 105 vessels due for demolition, constituting 15% of scrapped vessels. Turkey accounted for 10% of vessels, recycling 70 ships in 2021. The other 15% were scrapped in locations such as China, South Korea, Norway and Denmark.

Scrap Price and Demolition Buyers

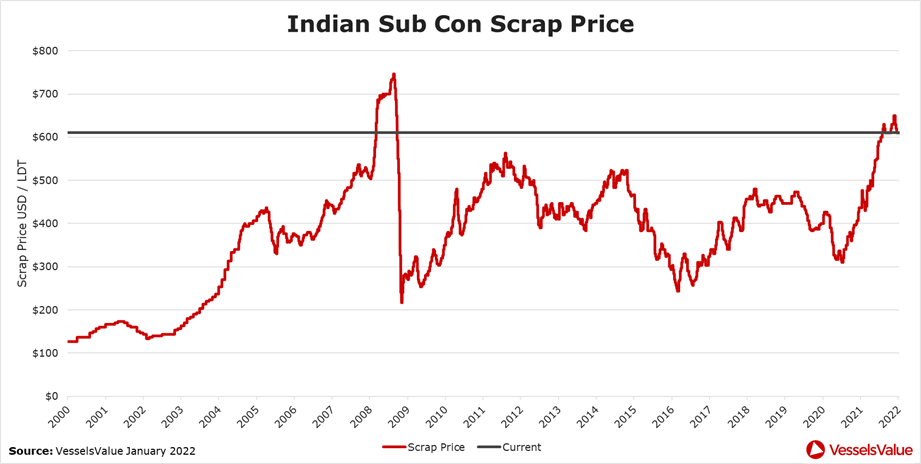

2021 was an extremely strong year for scrap steel on the Indian Subcontinent. Averaged across Bulkers, Tankers and Containers, the Subcontinent scrap price has reached highs not seen since 2007. From the 1st of January to the 31st of December 2021, the average value increased from 400 USD/LDT to 610 USD/LDT, representing a growth of 53%.

This strong growth follows a recent increase in demand, a consequence of the manufacturing industry’s recovery from the Covid-19 pandemic. Towards the end of 2021, prices started to decline, which could be attributed to the spread of the Omicron variant of Covid-19, threatening new lockdown measures and the slowing down of industrial activity that accompanies them.

Averaged across Bulkers, Tankers, and Containers, the mean Bangladeshi scrap steel price for 2021 was 550 USD/LDT, making it the highest price for scrap in the Subcontinent. This strong value was buoyed by the surging steel price, and a relatively stable currency. Pakistan, despite high inflation and a tumbling rupee, came in second with an average 2021 scrap price of 543 USD/LDT, whereas India trailed at 535.4 USD/LDT. This lower price is possibly due to 92 out of 120 Indian breaking yards achieving class society Statements of Compliance (SoC) with the Hong Kong International Convention (‘for the safe and environmentally sound recycling of ships’), which could infer higher operating costs for scrapyard owners.

For reference, a VLCC such as the New Diamond (27,300 DWT, Jan 1997, Hanjin HI), which has an LDT of 38,968 MT, would fetch nearly half a million USD more (0.6mil USD) selling at the average annual Bangladeshi scrap price of 555 USD/LDT compared to selling at the average annual Indian price of 540 USD/LDT.

Cargo

Bulkers

In the Bulker sector, Handymaxes saw the highest number of vessels scrapped at 18, accounting for 30% of the total Bulker fleet. 15 Capesize vessels were scrapped (25%) and 14 Handy Bulkers (24%). At 32 vessels, just over half (54%) of Bulkers were delivered to Bangladeshi yards.

With Bulker rates softening since the Autumn of 2021 and EEXI regulation soon to come into force, we are likely to see an increase in the number of Bulkers sold for demolition in 2022 as owners are encouraged to offload smaller, older and less efficient vessels.

Notable Sales:

CAPESIZE: An Li (170,400 DWT, 01 June 2000, Sasebo country), Demo Price: 415 USD/LDT, VV Demo Price: 413 USD/LDT, Delivery Location: Bangladesh

HANDY BULKER: White Pearl (39,300 DWT, 21 February 1985, Komuny Paryskiej country), Demo Price: 443 USD/LDT, VV Demo Price: 436 USD/LDT, Delivery Location: Bangladesh

Tankers

The perfect storm of high steel price and low earnings made for a positive year in Tanker demolition, with a total combined deadweight of 14.2 mil DWT setting sail for the breaking yards of the Subcontinent and Turkey.

Over half (55%) of all Tankers scrapped in 2021 were Small Tankers, totalling 166 vessels. Handy Tankers and Aframax vessels comprised the largest portion of the remaining tonnage, at 59 and 33 vessels respectively, accounting for 11% and 20%. The final 14% is made up of 11 VLCCs, 17 Suezmax, 13 Panamax and 2 Post Panamax.

Of the 301 Tankers scrapped, 112 were delivered to Bangladesh, 84 to India, and 60 to Pakistan. The breaking yards of Aliaga, Turkey, demolished 12 vessels in 2021, a striking increase from 2020, when only 1 vessel, Suezmax Shuttle Tanker Vinland (140,320 CBM, Aug 2000, Samsung), was scrapped.

Notable Sales:

VLCC: Penny H (300,400 DWT, 31 January 1996, Mitsubishi HI country), Demo Price: 598 USD/LDT, VV Demo Price: 600 USD/LDT, Delivery Location: India

SMALL TANKER: Gema (19,800 DWT, 14 February 2001, Admiralty country), Demo Price: 616 USD/LDT, VV Demo Price: 600 USD/LDT, Delivery Location: India

Containers

The minimal demolition activity there was in the Containership sector was dominated by Feedermax vessels, which accounted for 8 out of the 11 Containerships sold for scrap (72%). The remaining 3 vessels were 2 Handy Containers and 1 Sub Panamax.

Smaller vessels comprising a large portion of Container demolition is a trend that continues from 2019 and 2020. In both these years, Feedermax and Handy Containers accounted for a similar proportion of boxship demolition deals: 70% in 2019 (62 vessels) and 71% in 2020 (59 Vessels).

The booming Container rates of 2021 ensured that it was only the oldest tonnage sent to the scrapyard. The scrapped vessels had a weighted average age of 31, with the range extending from 25 year old vessels, to the 70 year old Sub Panamax Lihue.

Notable Sales:

FEEDERMAX: Salam Mewah (1088 TEU, 06 February 1996, Kanasashi country), Demo Price: 450 USD/LDT, VV Demo Price: 457 USD/LDT, Delivery Location: Bangladesh

FEEDERMAX: Dole Ecuador (890 TEU, 10 February 1989, Fincantieri Ancona country), Demo Price: 620 USD/LDT, VV Demo Price: 614 USD/LDT, Delivery Location: India

Gas

Firm LPG charter rates meant for a fairly inactive year for demolition, with shipowners opting to get rid of older, smaller vessels. However, despite rates increasing since 2021, scrapping numbers still grew in 2021, up 2 from the 16 scrapped in 2020, potentially due to a fleet renewal as the LPG orderbook continues to increase.

Despite LNG scrapping numbers growing by 25% since 2020, when compared to other vessel types the number of LNG carriers being scrapped is relatively small comprising only 1.3% of cargo demolition. This is due in part to a young fleet; the average age of live LNG carriers is 10 years old. However, it could also reflect the market’s confidence in the sector, likely fuelled by a rapid growth in the price of LNG throughout 2021, with charter rates following suit. Talk of LNG as an important ‘transitional fuel’ has also no doubt contributed to the year’s low LNG scrapping numbers.

Notable Sales:

LARGE LNG: North Energy (126,885 CBM, 19 October 1983, Mitsubishi HI country), Demo Price: 710 USD/LDT, VV Demo Price: 690 USD/LDT, Delivery Location: Bangladesh

MGC: Standorf (33,619 CBM, 05 November 1990, Boelwerf country), Demo Price: 700 USD/LDT, VV Demo Price: 696 USD/LDT, Delivery Location: India

Small Dry

Small Dry demolition remained fairly stable in 2021, decreasing by only 3.0% from 2020. Of the 67 vessels scrapped, the majority, at 31, were General Cargo (46%).

A lack of MPP newbuilds has likely caused a decrease in MPP scrapping numbers, which were down by 36% since 2020.

Following the trend of the other cargo sectors, Small Dry vessels favoured scrapping in Bangladesh, with 20 vessels scrapped (30%). Interestingly, 14 were scrapped in Turkey, accounting for 20%, a greater proportion than any other ship type.

Notable Sales:

MPP (HEAVY LIFT): Dalian (30,000 DWT, 15 March 2004, Xiamen Shipbuilding Ind country), Demo Price: 477 USD/LDT, VV Demo Price: 413 USD/LDT, Delivery Location: Bangladesh

SMALL HANDY: Omar B (11,700 DWT, 01 February 1983, Factorias Juliana country), Demo Price: 370 USD/LDT, VV Demo Price: 402 USD/LDT, Delivery Location: Pakistan

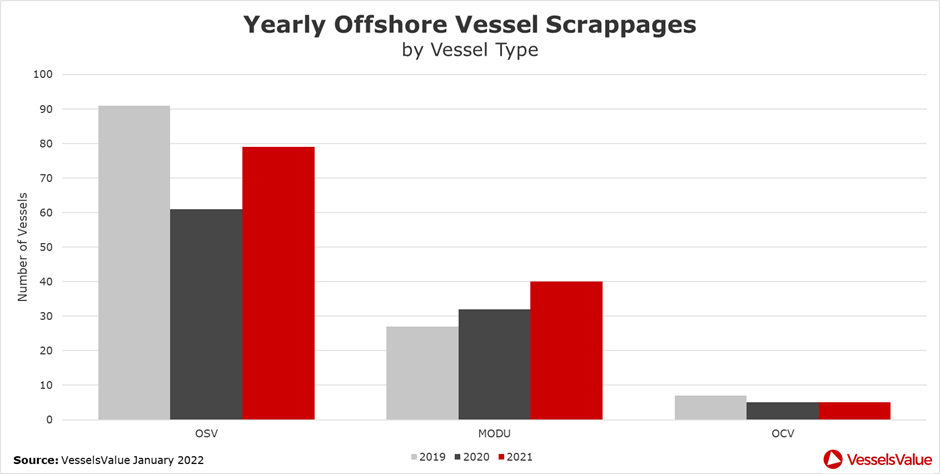

Offshore

As a result of the Covid-19 pandemic, the Mobile Offshore Drilling market is experiencing one of the toughest periods since the oil price crash of 2014/2015. Large US listed rigs owners such as Noble Drilling, Pacific Drilling, Diamond Offshore and John Fredriksen owned Seadrill, have recently been forced to go through Chapter 11 Bankruptcy (some for the second time in 5 years). Many of these rig owners as part of the pre package bankruptcy agreement have been forced to review their fleet and remove non core tonnage.

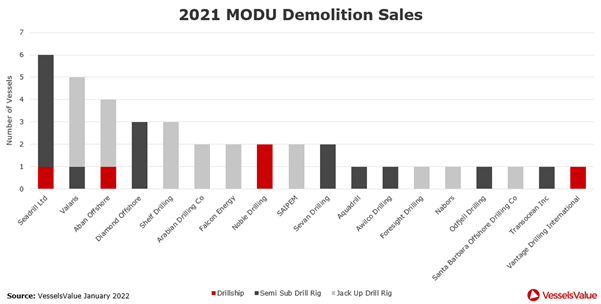

Figure 4 shows the total number of MODUs scrapped by owner and type during 2021.

Seadrill has been the most active during 2021, as mentioned this has been driven by their recent Chapter 11 Bankruptcy. The Seadrill rigs sold for demolition are outlined below.

Offshore Notable Sales:

West Pegasus (10,000 ft, 2011, Jurong) sold for USD 7.6 mil. Rig cold stacked since June 2016 Norway

West Eminence (7,800 ft, 2009, Samsung) sold for USD 7.6 mil. Rig cold stacked since 2015 Canary Islands

West Navigator (8,200 ft, 1998, Samsung) sold for USD 11.9 mil. Rig cold stacked since 2014 Norway

West Venture (5,905 ft, 1999, Hitachi) sold for USD 6.5 mil. Rig cold stacked since 2016 Norway

West Alpha (2,000 ft, 1986, NKK) sold for USD 4.2 mil. Rig cold stacked since 2016 Norway

All were sold ‘as is’ to a Turkish demolition cash buyer Rota Shipping for a total price of USD c.38 mil.

In the same month (May 2021) we also saw Seadrill sell the Sevan Driller (10,000 ft, 2009, Nantong Cosco) ‘as is’ Indonesia for an undisclosed price. Rig cold stacked since 2016.

Fast forward to the later part of 2021 and the Seadrill demolition continued, this time with the following:

West Sirius (10,000 ft, 2008, Jurong) (SS/DD overdue) cold stacked since Apr 2015

West Orion (7,874 ft, 2010, Jurong) (SS/DD overdue) cold stacked since Nov 2016

Sevan Brasil (10,000 ft, 2012, Nantong COSCO KHI) (SS due Feb 2022/DD overdue) cold stacked since Sep 2020

Interestingly, a large proportion of Seadrills demolition activity was for modern MODUs, which applied significant pressure on MODU assets values across the age curve.

At the other end of the age spectrum, Deloitte sold four vintage MODUs (one Deepwater Drillship and three Jackups) on behalf of Aban Offshore. Outlined below are the Aban Vintage Demolition sales which occurred in Q4 2021.

Aban Abraham (6,600 ft, 1976, IHC Gusto Engineering) (SS/DD overdue) warm stacked since Dec 2018, sold for 431 USD/LDT (circa USD 4.7 mil)

Aban V (300 ft, 1982, Ingalls) (SS/DD overdue) laid up since Aug 2015, sold for 301 USD/LDT (circa USD 1.8 mil)

Aban VI (250 ft, 1975, Far East Shipbuilding) (SS/DD overdue) laid up since Nov 2016, sold for 284 USD/LDT (circa USD 2.2 mil)

Aban VII (250 ft, 1973, Marathon Le Tourneau) (SS/DD overdue) laid up since Nov 2016, sold for 287 USD/LDT (circa USD 1.8 mil)

All were sold ‘as is’ to UAE

demolition cash buyer Last Voyages DMCC for a total price of c.10.7 mil.

Conclusion

The demolition markets of 2021 were characterised by many of the same factors impacting shipping as a whole; a boom in Bulker rates and values, record breaking growth in the Containership sector, and a static Tanker market. These elements combined with the rallying scrap steel price to produce a strong, active Tanker demolition market, and large decreases in Container and Bulker scrapping. Offshore demolition buyers also benefitted from the strong steel price and lacklustre Offshore sector.

Although the steel price could be heading for a correction in 2022, continued low Tanker rates and a declining Bulker market could spell an active year for demolition in these sectors. Conversely, the Container and Gas markets look to stay strong, and it may not be until 2023 that a real increase in Container and Gas scrapping is observed.

VesselsValue data as of January 2022.

Glossary

VesselsValue calculates demolition value from the following formula:

LDT: The lightweight displacement tonnage of the vessel. Defined as the weight of the ship excluding cargo, fuel, water, ballast, stores, passengers, crew etc. The equation assumes that the structure of a ship is 100% steel, which it almost is.

Subcon Scrap Price: The price of scrap steel in the Subcontinent. This includes Pakistan, Bangladesh and India, so the highest of the three is chosen. Measured in USD/lt.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment