Demolition Report, June – October 2021

Introduction

Since the end of H1, there have been 163 cargo vessels sold for demolition, a 4.5% increase on the same period in 2020 when 145 vessels were scrapped, and a 63% increase from 2019 when only 100 vessels were scrapped. These vessels had a combined DWT of 6.3 mil and a minimum combined scrap value of over USD 825 mil.

57 of these vessels were acquired by buyers in Bangladesh, constituting over a third (35%) of all vessels sold. A total of 49 vessels were sent for demolition in India, constituting 30% of the sales. Both countries harbour strong buying appetites as their construction industries bounce back from Covid-19 lockdowns.

Pakistan trailed behind accounting for only 14% of demolition deals with a total of 23 vessels sent for scrap. This was likely due to the Pakistani rupee reaching all time lows against the dollar, decreasing the buying power of Pakistani shipbreaking yards.

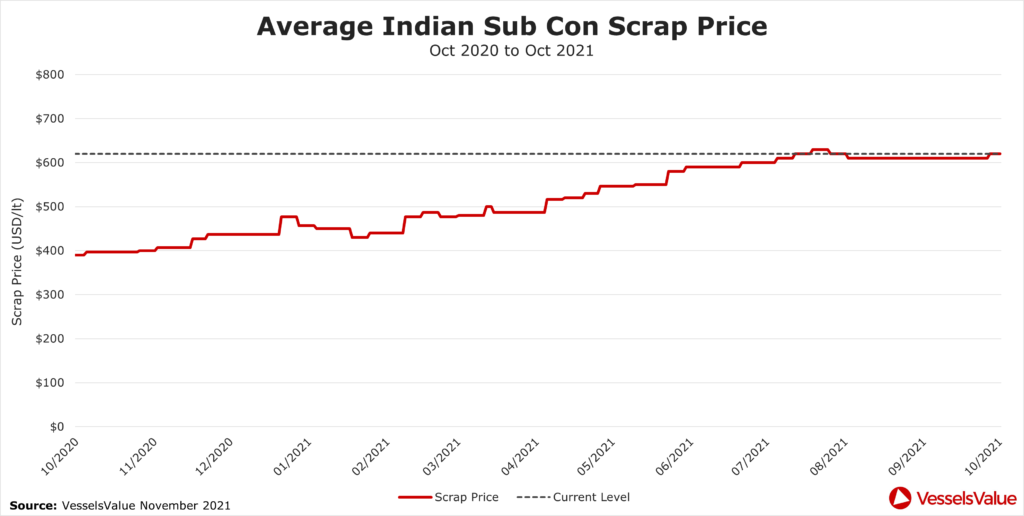

Between the end of June and the end of October 2021, the average Indian Subcontinent scrap price across Bulkers, Tankers and Containers rose by around 5% from 590 USD/lt to 620 USD/lt. Scrap prices peaked around the end of August and have since stabilised, marking the end of a period of strong and significant growth.

At the end of October 2021 the scrap price for a Tanker was 620 USD/lt. By contrast, prices in October 2019 were 390 USD/lt. Applying these scrap prices to a typical VLCC of 44,000lt produces two very different residual asset values. Today the residual price of a VLCC is USD 27.7 mil, compared to October 2019 when the same vessel would achieve a price of USD 19.8 mil. Although the difference is significant, at about USD 8 mil, levels have not quite reached the all time highs seen back in 2008, when scrap prices almost reached 760 USD/lt.

Recent trends in Subcontinent scrap price can be seen in Figure 1.

Bulkers

Throughout 2021, Bulker freight rates have increased significantly. For example, the Capesize 54 TCA increased from 32,604 USD/day on the 30th June to a peak of 86,953 USD/day on the 7th October, an increase of 167%. Rates have since declined to 47,950 USD/day on the 25th October. Unsurprisingly, this has slowed down the number of Bulkers being sent for demolition.

31% of the vessels scrapped between the end of June 2020 and the end of October 2020 were Bulkers, accounting for a total of 48 ships. Today, due to the booming charter market, this number has fallen to only 8 Bulkers, a drop of 83%.

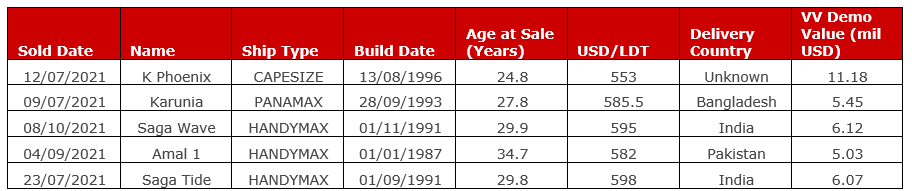

Example demolition sales are shown below:

Containers

As is widely reported, 2021 has been a record breaking year for Containerships, with port congestion and increasing demand causing freight rates to reach incredible highs.

Just as with Bulkers, the percentage of Containerships scrapped between June and October 2021 has dropped dramatically since last year as shipowners have been holding onto their tonnage. There were only 2 Containerships scrapped between June 30th and October 25th 2021, representing a 94% decrease from 2020, where 34 Container vessels were sent for demolition.

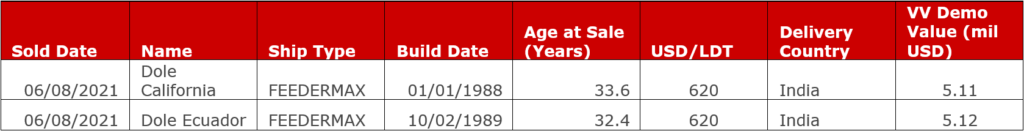

The vessels scrapped were two 32 and 34 year old Feedermaxes, sent for HKC “Green Recycling” at Alang, India.

Tankers

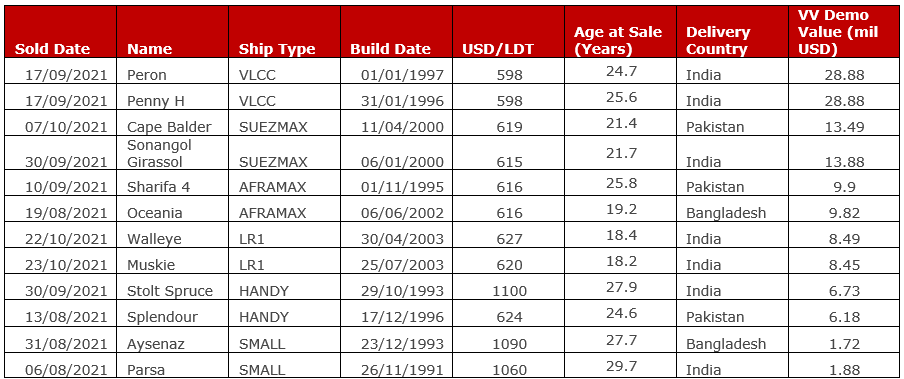

112 Tankers have been scrapped between the end of H1 2021 and today, making up 69% of all cargo vessels scrapped in the same period. For comparison, in 2020 only 26 vessels were scrapped. Following a year of stagnant freight rates in 2021, owners are understandably capitalising on the booming scrap prices and scrapping tonnage.

With the upcoming winter and countries slowly lifting travel restrictions, we may see a Tanker rally and consequently a foot on the breaks for Tanker demolition sales.

Conclusion

Overall, scrapping for Bulkers and Containers is unlikely to increase whilst both benefit from a booming charter and S&P market, despite the rising scrap steel prices. Those same high scrap prices, coupled with sedentary freight rates, will ensure that Tanker scrap numbers remain steady until rates can break free of their current position.

Data as of end October 2021.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment