Half year review: Demolition

Introduction

The first half of 2021 saw 275 Cargo vessels sold for scrap, up 40% and 33% compared to 2020 and 2019, respectively.

The 275 scrapped vessels have a combined DWT of 11.9 mil and a total scrap value of over USD 1 bil. 131 tankers were scrapped, accounting for nearly half of all cargo vessels scrapped in H1 2021.

The increasing scrapping numbers are a direct result of exceptionally high scrapping rates, which rose and continue to rise throughout 2021. The end of H1 2021 saw Container scrapping prices reach 600 USD/LT, levels not seen for nearly 13 years. The surge in scrapping prices has been fuelled by the ever growing rise in steel price and demand. A demand catalysed by lockdown restrictions causing logistical issues for construction sites across the world.

The unprecedented earnings seen in H1 2021 for the Bulker and Container sectors saw owners capitalise in both the charter and S&P market, turning their back on the demolition market despite the lucrative scrapping prices. Tanker owners, however, were more tempted by the high scrapping prices, but still, the majority are choosing to cling onto older assets in the hope of a full market recovery.

Financial pressures forced upon the Offshore sector due to Covid-19 has seen many owners scrapping their non-core assets. This is a result of pre agreed bankruptcy agreements which requires complete fleet reviews.

Cargo

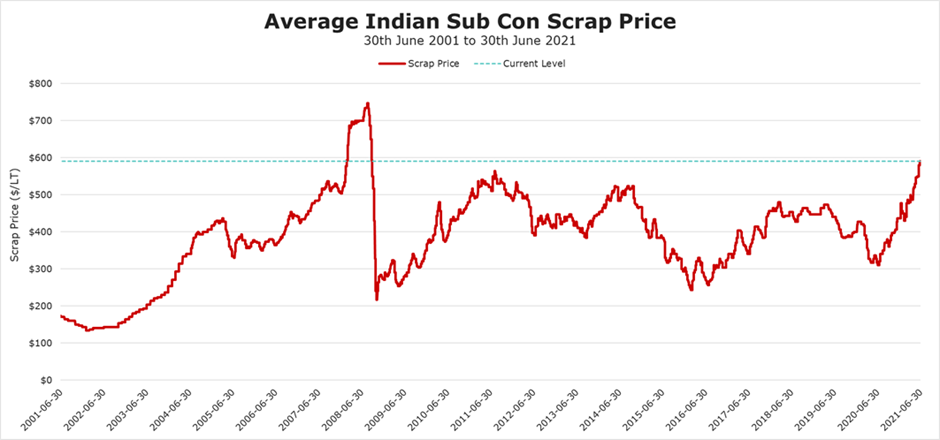

Figure 1 shows the average scrap price in the Indian Sub Con. The Indian Sub Con represents the highest scrap price available between Bangladesh, India and Pakistan recycling yards.

The previous ten year high of 560 USD/LT was quickly surpassed at the start of June 2021 and current prices are closing in on a 13 year high. In the first half of the year, the scrap price increased approximately USD 0.86 every day. If this growth rate continues then the 2008 all time high of 754 USD/LT will be reached by the end of the year.

The end of H1 2021 scrap price is 86% higher compared to the scrap price end of H1 2020.

Below are some examples of vessels achieving high scrap prices on the demolition market.

- 18th June 2021 MR1 TNKR (Chem / Product): Dubra (35,900 DWT, Jul 1999, Daedong) sold for 592 USD /LT – Pakistan

- 18th June 2021 MR2 TNKR (Chem / Product): Elka Angelique (44,900 DWT, Jun 2001, Brodosplit) sold for 590 USD /LT – Pakistan

- 11th June 2021 FEEDERMAX (Gantry): Dole Costa Rica (890 TEU, Oct 1991, Fincantieri Ancona) sold for 585 USD /LT – India

- 10th June 2021 CAPESIZE BC: Win Win (170,100 DWT, Nov 2001, IHI) sold for 580 USD /LT – Bangladesh

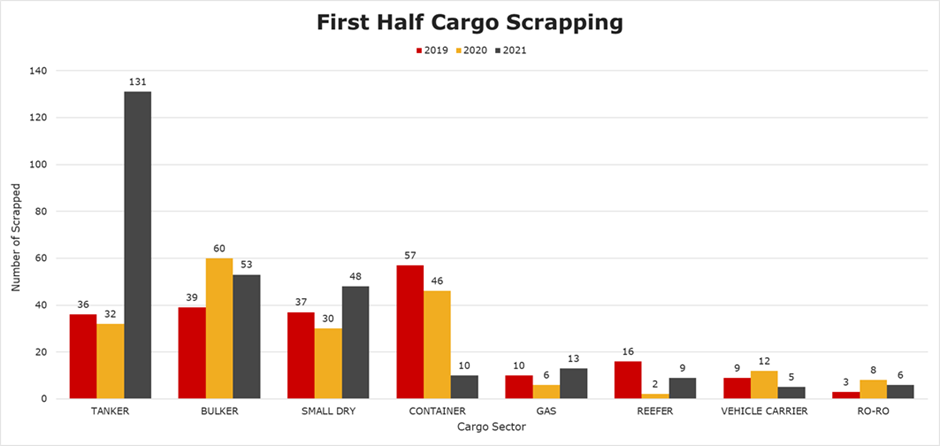

Figure 2 shows the number of vessels scrapped in the first half of 2019, 2020 and 2021 by sector.

The number of Tankers scrapped in H1 2021 is up four-fold compared to 2020 and 2019. For reference, the total number of Tankers scrapped throughout 2020 and 2019 was 92 and 91 respectively. It would not be a surprise if Tanker scrapping continues to grow as earnings continue to remain at extremely low levels.

Despite the high scrap prices, Bulker owners are tentative to scrap any older tonnage due to the exceptionally high earnings. Scrapping numbers have remained comparatively low for H1 2021, down 13% from H1 2020.

Expectedly, Container scrapping numbers are down 78% from 2020 as the sector relishes the extreme earnings. 7 of the 10 Containers scrapped this year, were small Feedermaxes, all 25 years or older. Even if scrap prices continue to rally upwards it is unlikely that we will see many more Containers scrapped in the second half of the year.

The Small Dry sector experienced a generous uptick in scrapping numbers (up 60% from 2020), as several owners opted to benefit from the high scrapping rates and scrapping their older tonnage. The average scrapping age for H1 2021 was 34 years.

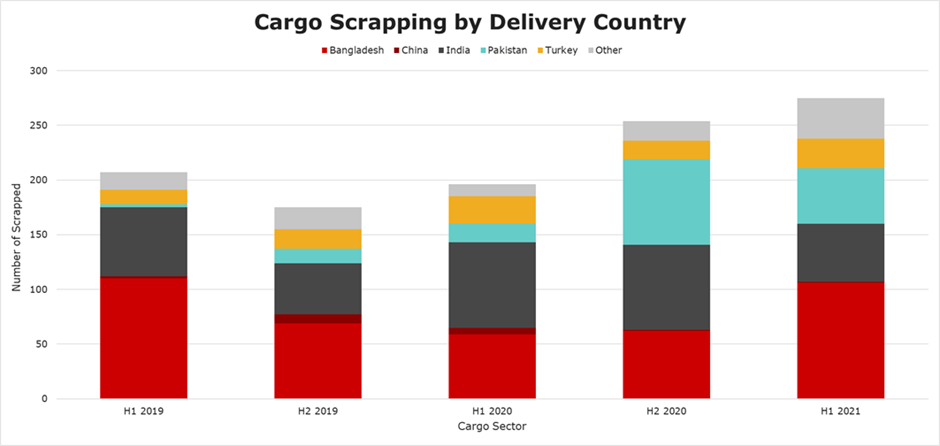

Figure 3 breakdown by half years the number of vessels scrapped in each location for 2019, 2020 and 2021.

Since the second half of 2019, the number of vessels scrapped each year has grown year on year.

The battle for the top spot for 2020 and 2021 pulled numerous untested elements into play such as rising Covid-19 cases, yard lockdowns and lack of oxygen supply which were all unchartered waters for recycling yards.

Bangladesh was briefly knocked off its top spot in March as Pakistan offered more competitive scrap pricing. During April, all three countries, Bangladesh, India and Pakistan suffered due to rising Covid-19 cases. India was particularly impacted as it saw another set of lockdown restrictions imposed.

Notwithstanding the relentless pandemic, scrapping prices and numbers continued to rise. Bangladesh took the lion’s share in H1 2021, scrapping 106 vessels, up 80% from H1 2020. India and Pakistan scrapped 53 and 51 vessels respectively, down from their impressive performance in the latter half of 2020.

Offshore

As a result of the Covid-19 pandemic, the Mobile Offshore Drilling market is experiencing one of the toughest periods since the oil price crash of 2014/2015. Large US listed rigs owners such as Noble Drilling, Pacific Drilling, Diamond Offshore and, John Fredriksen owned Seadrill, have recently been forced to go through Chapter 11 (some for the second time in 5 years). Many of these rig owners as part of the pre package bankruptcy agreement have been forced to review their fleet and remove non-core tonnage.

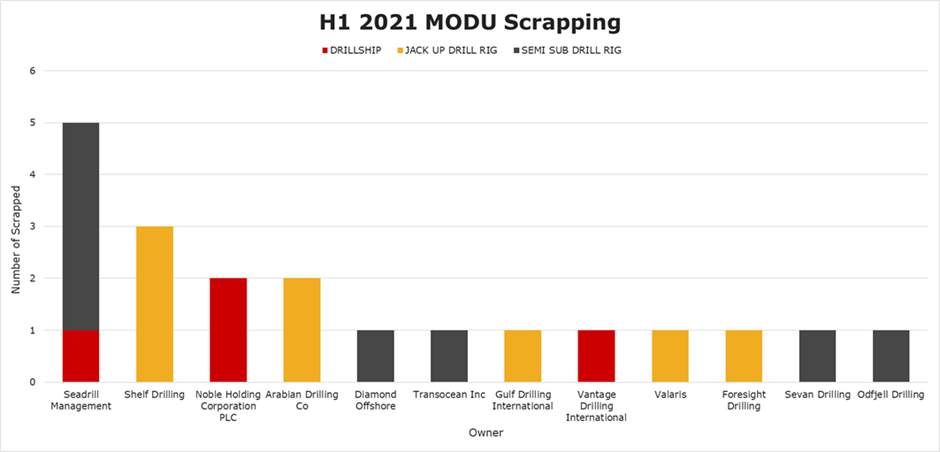

Figure 4 shows the total number of MODUs scrapped by owner and type from January 2021 to June 30, 2021.

Seadrill has been the most active during the first half of 2021, as mentioned this has been driven by their recent Chapter 11 Bankruptcy. The Seadrill rigs sold for demolition are outlined below.

- West Pegasus 10,000 ft blt 2011 Jurong sold for USD 7.6 mil. Rig cold stacked since June 2016 Norway.

- West Eminence 7,800 ft blt 2009 Samsung sold for USD 7.6 mil. Rig cold stacked since 2015 Canary Islands.

- West Navigator 8,200 ft blt 1998 Samsung sold for USD 11.9 mil. Rig cold stacked since 2014 Norway.

- West Venture 5,905 blt 1999 Hitachi sold for USD 6.5 mil. Rig cold stacked since 2016 Norway.

- West Alpha 2,000 ft blt 1986 NKK sold for USD 4.2 mil. Rig cold stacked since 2016 Norway.

All were sold ‘as is’ to a Turkish demolition cash buyer Rota Shipping for a total price of USD c.38 mil.

We also saw the following rig sold to Indonesia for demolition, Sevan Driller 10,000 ft blt 2009 Nantong Cosco. Reported sold to Indonesian demo buyer on ‘as is’ basis for an undisclosed price. Rig cold stacked since 2016.

Conclusion

Extreme scrap prices, costly new environmental regulations (sulphur cap, BWMS etc) and an ever ageing fleet was the perfect blend to see scrapping numbers blown out of the water and some impressive records to be set.

However, with Containers and Bulkers making so much money, and Tankers having done so previously, owners are hanging onto their vessels despite the huge temptation from scrapping prices.

If the steel demand continues to rally the demolition scrap price for shipping, then it is likely that scrapping numbers will increase throughout the year, especially if Bulker and Container rates begin to soften.

The high steel price is positive for market fundamentals in oversupplied sectors as it encourages scrapping but bad for undersupplied sectors as it heightens new building prices.

VesselsValue data as of July 2021

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment